Is Pet Insurance Worth It?

If you’re considering pet insurance, the first question you’re likely to have is whether it’s “worth it,” especially if your pet is healthy and doesn’t see a vet very often.

But then again, this is a decision that will affect the well-being of your pet. Before you decide, it’s always a good idea to dig into the data to see if it makes sense to get a pet insurance plan.

Here’s some data on the cost of emergency vet visits versus the average cost of pet insurance plans, plus insight on why you might want pet insurance for your pet at different life stages and a few questions to help you decide.

Cost of Unplanned Vet Visits

Veterinary care is expensive, and if current trends continue, it will be even more expensive in the years to come.

No one wants to think about their pets developing a serious illness or being involved in an accident, so we often don’t plan for those expensive veterinary bills. But planning is the best way to provide long-term care for your pet and reduce your own anxiety over high vet bills.

The 2021-2022 APPA National Pet Owners Survey estimates that pet parents in the United States spent $109.6 billion on their pets in 2021, roughly 30% of which ($32.3 billion) was spent on veterinary care and veterinary products.

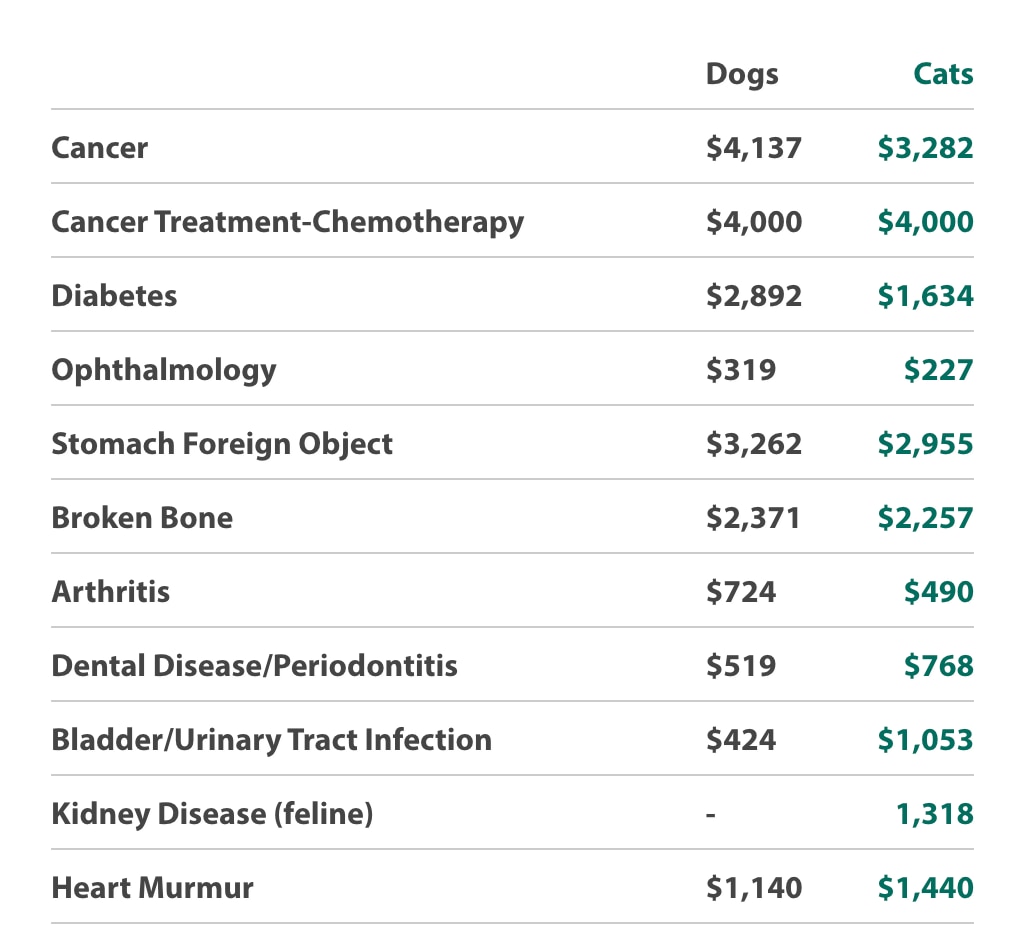

Those are big numbers, but you probably want some specifics. Care Credit has put together a table showing what complex or emergency veterinary care can cost. Keep in mind that this is only for the first year of treatment, and these numbers are from January 2017 to May 2020.

All emergency visits will include an exam and tests, called diagnostics, and potentially an MRI or CT scan.

-

Exam: $100-$150

-

Diagnostics: $400-$650 (bloodwork, urinalysis, x-ray; if ultrasound is included, could be up to $1000)

-

MRI / CT scan: $1500-$3000 (includes anesthesia and care to perform imaging)

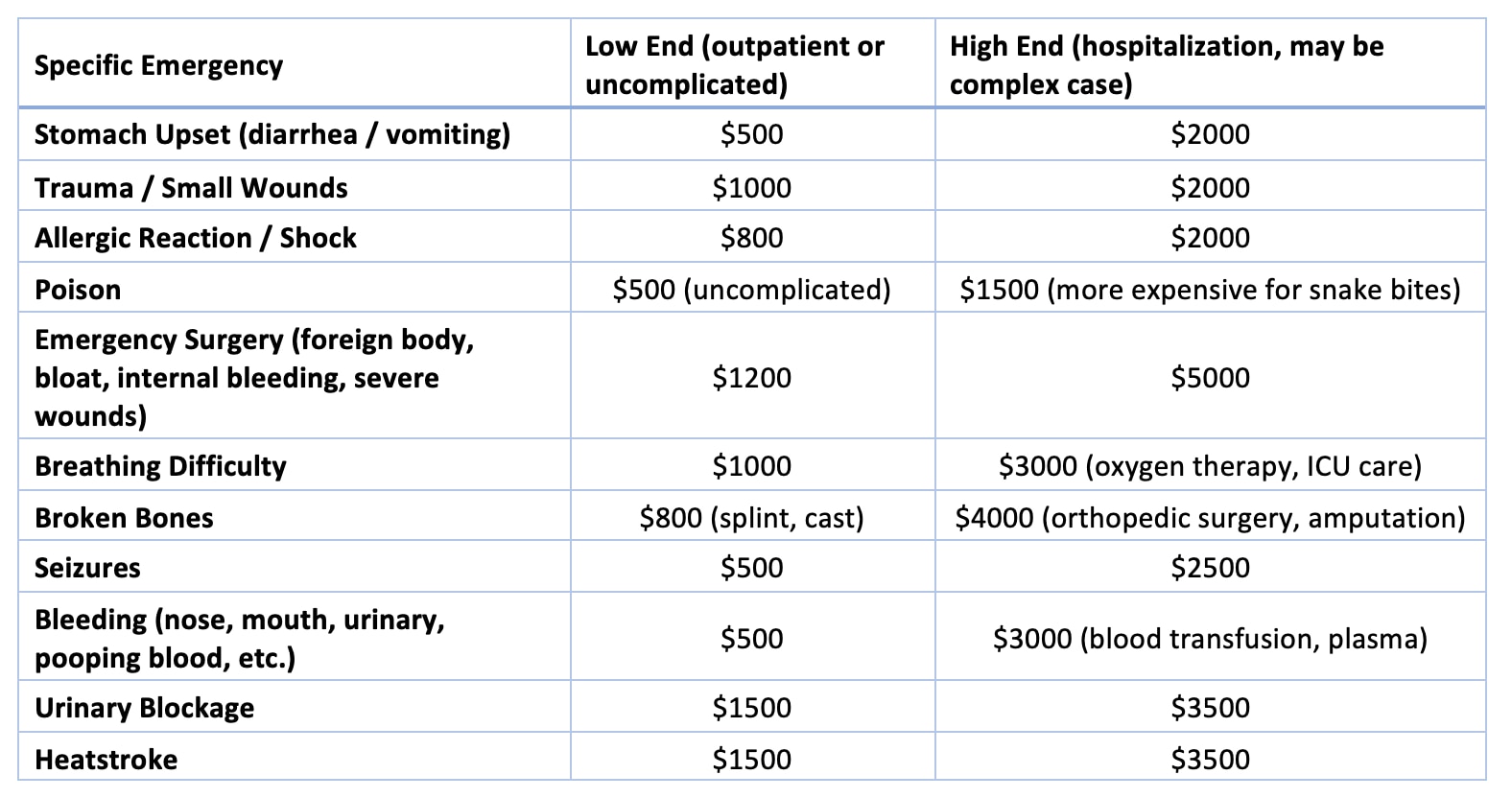

And then you will also pay different costs depending on your specific emergency. The following chart will give you an idea of what a “typical” visit to an emergency veterinarian might cost:

Based on these expenses, it’s not surprising that 45% of dog owners and 38% of cat owners who replied to the Synchrony Lifetime of Care Study said that they were not ready for pet-related expenses.

Cost of Pet Insurance

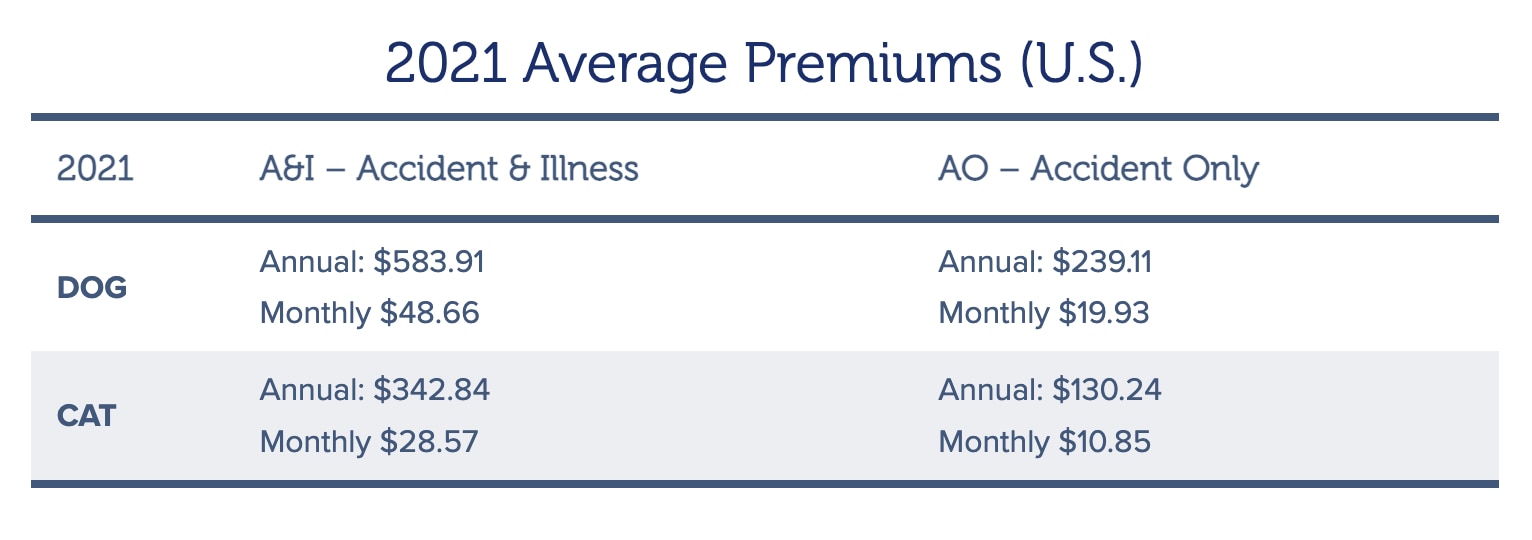

With these expenses in mind, let’s see how much you can expect to pay for pet insurance. These numbers are only averages. The exact amount will depend on many factors, including your pet’s age, breed, and health status; where you live; and the specifics of the policy you choose.

These are the average premiums in the United States for 2021, as calculated by the North American Pet Health Insurance Association:

Comparing the Cost of Veterinary Care Versus Pet Health Insurance

According to the Synchrony Study, the annual cost of health-related expenses for dogs ranges between $534 and $1285. For cats, annual health-related expenses fall between $374 and $965.

Looking at the NAPHIA numbers, you can see that the average annual premiums for pet insurance fall at or below the low end of the range for health-related expenses for both dogs and cats.

So strictly from a numbers point of view, is pet insurance worth it? While this comparison is certainly not exact (some health-related expenses won’t be covered by insurance), it does show that the cost of pet insurance is reasonable.

Unless you are very lucky and your pet manages to avoid significant illness or injury throughout their life, there is a good chance that you’ll be happy that you purchased pet insurance.

The Benefits of Pet Insurance

Saving money in the long-term is only one potential benefit of pet insurance. Another major plus is spreading out the cost of care through monthly premiums. And don’t underestimate the peace of mind you’ll have knowing that you’ll be able to provide your pet with the care they need if they are in an accident or become sick.

How Likely Is It That I'll Use My Pet Insurance?

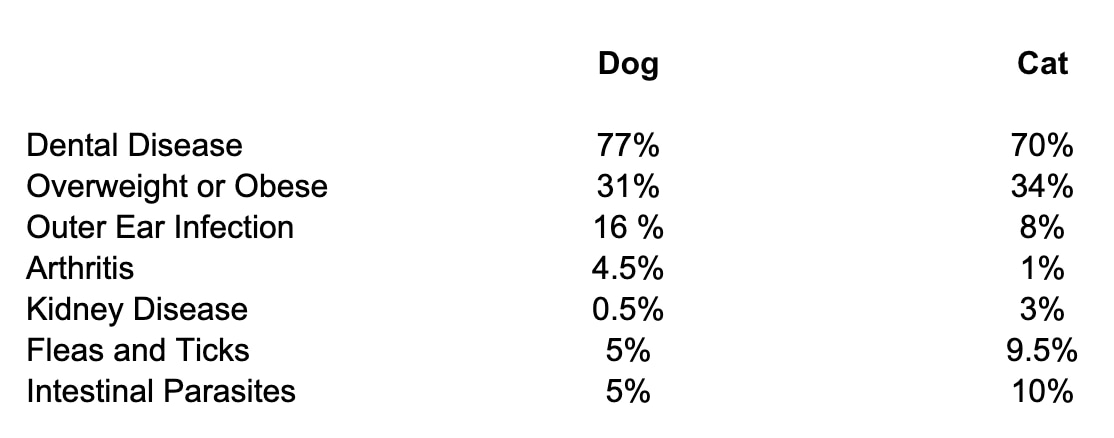

While you certainly don’t want your pet to get sick or injured, it might be helpful to know that at some point they will likely develop a health problem that requires veterinary attention. Statistics from 2017 show the percentage of dogs and cats who were brought to their veterinarian for various diseases and issues.

Diabetes, heartworm disease, and allergies were also prevalent enough to be included in this report. Exactly what type of disease or injury you might have to face depends on many factors, including your pet’s age, breed, lifestyle, and the level of preventive care they receive, but it’s probable that you’ll be seeking care for your pet at some point.

Is Pet Insurance Worth It for My Pet?

Pet insurance offers a range of benefits throughout a pet’s life, not just when your dog or cat gets older!

-

Kittens and Puppies–Young animals are at higher-than-average risk for many health problems. Their immune systems are not fully developed, and it takes time to get through their vaccination series. Potentially life-threatening infectious diseases like canine parvovirus and feline panleukopenia most often affect young or poorly vaccinated pets. Intestinal parasites are also a big problem for kittens and puppies.

-

Adult Cats and Dogs–Pets who are in their prime years tend to be at their most healthy. However, problems do still arise. For example, active dogs are at risk for injuries like cranial cruciate ligament ruptures, and cats who have been gaining a little weight every year may now be developing diabetes mellitus. Also, most pets have dental disease by the time they are 3 years old.

-

Feline and Canine Senior Citizens–The golden years are when we start to see pets developing symptoms associated with chronic diseases, like arthritis. This is also when the risk of cancer is at its highest.

-

Purebred Cats and Dogs–Purebred pets are at increased risk for certain diseases that have a genetic basis.

-

Special Situations–Take a look at your pet’s lifestyle and personality. Does your cat go outdoors? Then traumatic injuries are quite likely. Is your dog a dumpster diver? Then there’s a good chance you’ll be dealing with gastrointestinal problems.

What Pet Insurance Covers

To get the most bang for your buck, you want to pick an insurance policy that covers the conditions your pet will most likely need care for, which takes research. Different policies cover (and exclude) different things.

In general, pre-existing conditions are not covered, which is one benefit to purchasing a policy when your pet is young. Some hereditary conditions might be excluded for at-risk breeds.

Unsurprisingly, more expensive plans tend to cover more, while cheaper plans usually have more exclusions, higher deductibles and copays, or lower reimbursement rates and caps on payment.

Most pet insurance policies cover:

-

Surgery

-

Diagnostic tests like bloodwork, x-rays, and ultrasounds

-

Emergency care

-

Hospitalization

-

Treatment for illnesses (unless you purchase an accident-only policy)

Preventive care, like routine checkups and vaccines, is usually excluded, although add-on or stand-alone pet wellness policies are available.

Questions That Will Help You Decide

How do you know if pet insurance is right for you? Asking yourself the following questions can help:

-

Can I pay for an unexpected veterinary emergency right now?

-

Am I willing to euthanize my pet if I can’t afford treatment?

-

Could I benefit from spreading out the cost of my pet’s care?

-

Do I want the peace of mind that comes with knowing my pet can get the care they need?

If you answered no to the first two questions or yes to questions three or four, it’s time to consider purchasing pet insurance for your fuzzy family members.

Featured Image: iStock.com/bulentumut

Help us make PetMD better

Was this article helpful?